Wonderful guide:Uber and Didi are panicking, and even BMW and Benz are starting to enter the online car-hailing industry; the electrification of cars may make a large number of workers unemployed, and the Hyundai Automobile Union warns that 70% of employees may lose their jobs; progress always comes at a price, and Waymo and Jaguar Land Rover insist on driverless testing. FAW and its two listed companies are ice and fire, FAW Xiali lost more than 1.64 billion yuan, and FAW cars turned around; selling lithium is too profitable, and Ganfeng Lithium’s first-quarter performance soared.

1. BMW and Daimler join forces

Plan ahead to break into the online ride-hailing market

On March 28, BMW Group and Daimler Group signed a contract to establish a joint venture to integrate their respective mobility service business modules, including shared cars, ride-hailing services, parking services, charging networks, and multimodal transportation.

In the contract, the two parties made it clear that "each party will own 50% of the joint venture. However, in their respective core business areas, the competitive relationship between the two parties will remain unchanged".

Comment: Although Internet companies seem to understand their users better, they cannot support the huge supply chain, capital and talent advantages of vehicle manufacturers.

2. Hyundai warning

70% of employees could lose their jobs

The head of Hyundai Motor’s labour union warned on the 26 March that workers at the company could face a crisis similar to that at General Motors of the US in South Korea, largely because of falling sales in key global markets. Three of Hyundai’s five Ulsan plants have asked workers to take long holidays as sales of older SUVs such as sedans and Santa Fe slow in the US and other markets.

The concern is that the Hyundai Motor Union forecasts that the strong development of electric vehicles could cost the company 70% of its jobs, because electric vehicles have very little demand for engines and transmission parts.

Comments: It may be too early to draw conclusions. The problem that Hyundai needs to solve may not be whether electric vehicles will replace gasoline vehicles.

3. Peugeot Citroen

Established a car rental company with Dongfeng Automobile

On March 26, French automaker Peugeot Citroen (PSA Group) said it plans to establish a joint venture with China’s second-largest auto group Dongfeng Motor to provide leasing services to the Chinese auto market.

Shenlong Automotive, PSA’s joint venture with Dongfeng Motor, will own 50 per cent of the new leasing company, while Dongfeng Motor Group and Banque PSA Finance, PSA’s financial arm, will each hold 25 per cent.

Comment: The product competitiveness is getting weaker and weaker, how can it be possible to establish a leasing company to quench the thirst far away.

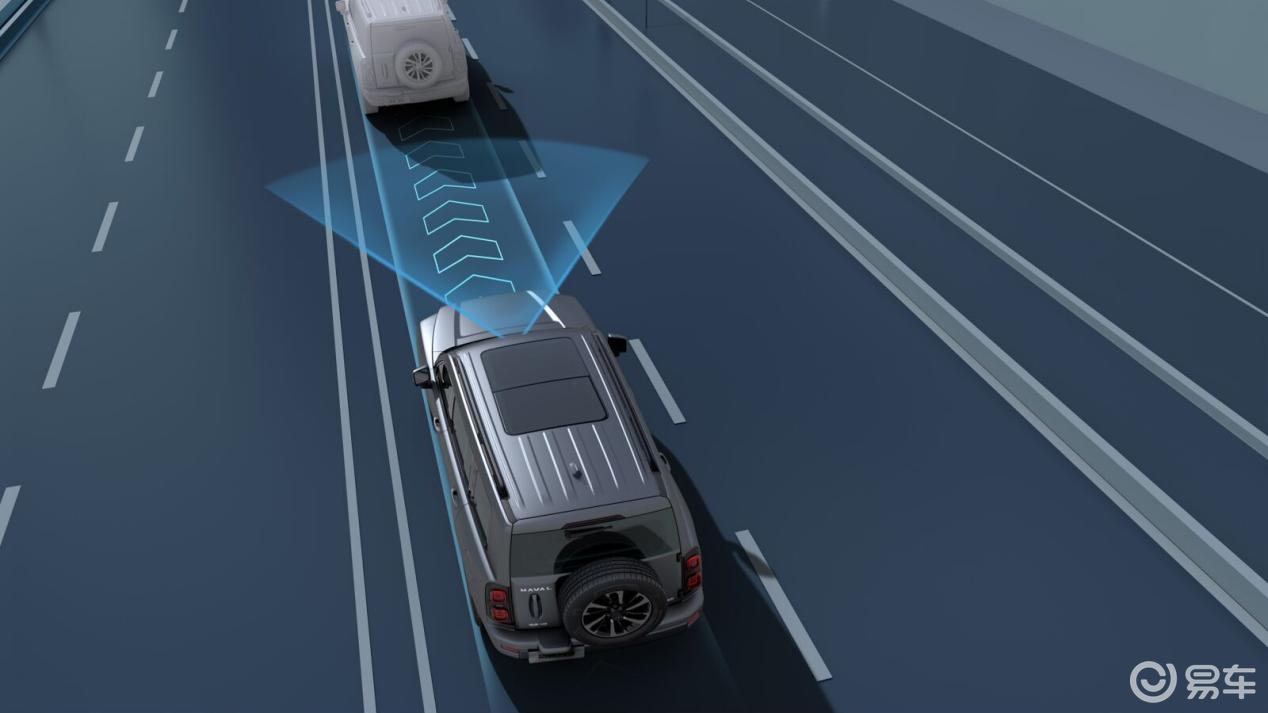

4. Google parent company Alphabet Inc.

Believing in autonomous driving, Waymo partners with Jaguar Land Rover

On March 27, Alphabet Inc’s driverless car company Waymo signed an agreement with Jaguar Land Rover, and the two companies will jointly produce 20,000 electric driverless car I-Pace. These SUVs will begin public road tests at the end of 2018 and officially join the Waymo ride-hailing team in 2020.

In addition, Waymo will launch a fully driverless service in Phoenix this year, allowing the public to use these vehicles freely within the service area.

The head of Waymo said he believes the technology developed by the company can detect pedestrians crossing the road in time to avoid accidents similar to those caused by Uber’s autonomous car in Arizona.

Comments: Historical scientific and technological progress always comes at a price.

5. NVIDIA

Suspension of autonomous driving test program

On March 27, Nvidia, which has been aggressively marketing its computing platform to autonomous cars, announced that it would suspend testing of its self-driving technology on public roads, largely because of a fatal accident involving an Uber autonomous car in March.

The company will suspend its self-driving fleet testing program, which is currently testing on public roads in California, New Jersey, Germany and Japan. Uber uses Nvidia’s computing technology in its self-driving test car, the Volvo XC90.

Comments: Unlike Google’s autonomous driving, Nvidia’s attitude is more responsible.

6. BYD

First quarter results are expected to decrease by 75% -92%

On March 27, BYD announced that the company’s revenue in 2017 was 105.915 billion yuan, an increase of 2.36% year-on-year; net profit was 4.066 billion yuan, a decrease of 19.51% year-on-year; basic earnings per share were 1.40 yuan. The company plans to pay 1.41 yuan (including tax) for 10 yuan.

BYD expects the company to achieve a profit of 50 million yuan – 150 million yuan in the first quarter of 2018, 75.24% -91.75% year-on-year.

Comments: It seems that the further decline of new energy subsidies and the application of new product designs will take time, which remains a serious challenge for BYD.

7. FAW car

Net profit of 281 million yuan in 2017 turned losses into profits

On March 31, FAW Car announced that its operating income in 2017 was 27.902 billion yuan, an increase of 22.86% year-on-year; the net profit attributable to shareholders of listed companies was 281 million yuan, a loss of 954 million yuan in the same period last year; basic earnings per share were 0.1728 yuan. The company plans to distribute cash dividends of 0.20 yuan (tax included) for every 10 shares.

Comments: Without Mazda, the FAW car might still be stuck in the mud.

8. FAW Xiali

Loss of more than 1.64 billion yuan in 2017

On March 31, FAW Xiali released the latest financial report, 2017 operating income 1.451 billion yuan, a decrease of 28.34%; net profit attributable to shareholders of listed companies 1.641 billion yuan, a decrease of 1110.64%; basic earnings per share – 1.0284 yuan. The company plans to distribute cash dividends of 0.20 yuan (tax included) for every 10 shares.

Comments: As a state-owned automobile group, all good resources are given to you!

9. SAIC Motor Group

Net profit in 2017 increased by 7.51% year-on-year.

On March 30, SAIC Motor Group released last year’s financial report. In 2017, the operating income was 870.639 billion yuan, an increase of 15.10% year-on-year; the net profit was 34.41 billion yuan, an increase of 7.51% year-on-year; the basic earnings per share were 2.959 yuan.

The company plans to pay a cash dividend of 18.3 yuan for every 10 shares. For shareholders, CSF’s shareholding increased from 2.96% at the end of the third quarter of last year to 3.57%.

Comments: The scale is there, as stable as an ox.

10. GAC Group

Net profit of nearly 10.80 billion yuan, an increase of 71%

On March 30, GAC Group announced its 2017 financial report. In 2017, its total operating income was about 71.575 billion yuan, an increase of about 44.84% year-on-year; the net profit attributable to the owner of the parent company was about 10.786 billion yuan, an increase of about 71.53% year-on-year; the basic earnings per share were about 1.65 yuan. The company’s annual report plans to transfer 10 yuan to 4 yuan 4.3 yuan.

Comments: Although the performance is very impressive, the GAC Group’s large ship may have encountered a reef.

11. Huayu Automobile

Completed the acquisition of a 50% stake in Shanghai Xiaoyi Lighting

Huayu Automobile recently announced that it has completed the delivery of 50% of the equity of Shanghai Xiaoti and the registration of changes to Shanghai Xiaoti’s industry and commerce. Shanghai Xiaoti Automotive Lighting Co., Ltd. has become a wholly-owned subsidiary of the company and officially changed its name to "Huayu Vision Technology (Shanghai) Co., Ltd.". Huayu Vision has been included in the company’s consolidated statements since March 1, 2018.

In 2017, Huayu Automobile achieved operating income of 140.487 billion yuan, an increase of 13.03% year-on-year; net profit of 6.554 billion yuan, an increase of 7.87% year-on-year; basic earnings per share of 2.079 yuan. The company plans to pay a cash dividend of 10.5 yuan for every 10 shares. For shareholders, the shareholding of CSF Company increased from 3.77% at the end of the third quarter of last year to 4.10%.

Comments: This car lamp company is still very good.

12. Ganfeng Lithium Industry

First quarter results are expected to increase by 125% -175%

Ganfeng Lithium Industry announced that the company expects the net profit attributable to shareholders of listed companies in Quarter 1 in 2018 to be 307.0163 million yuan – 375.2422 million yuan, an increase of 125% -175%.

Comments: It seems that the cost of raw materials for power batteries will continue to rise.

?

? ?

? ?

? ?

? ?

?