Sheng: the "past lives" of heart stent

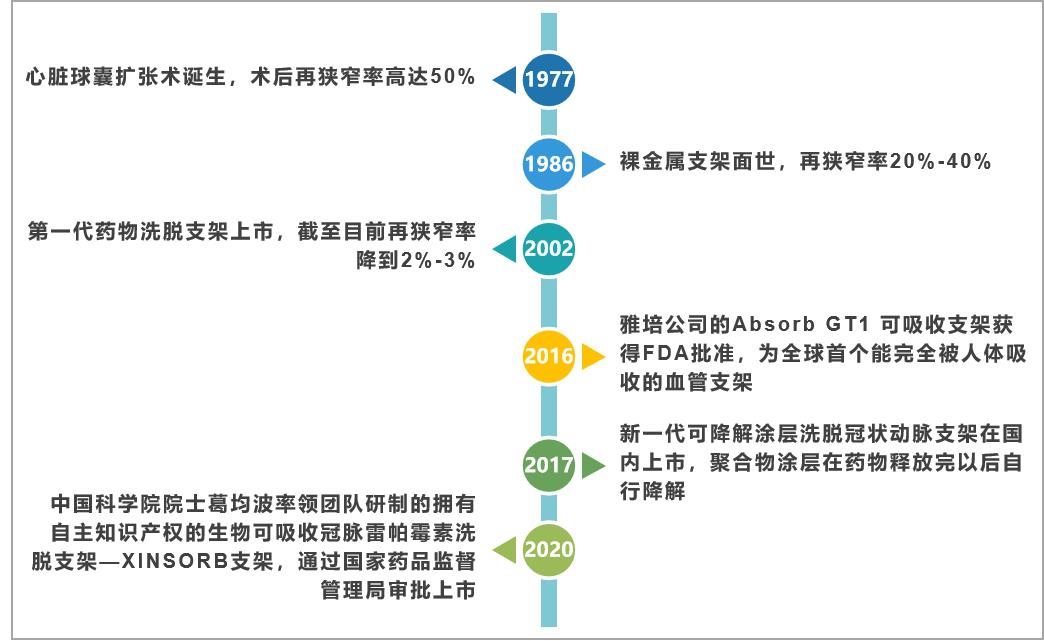

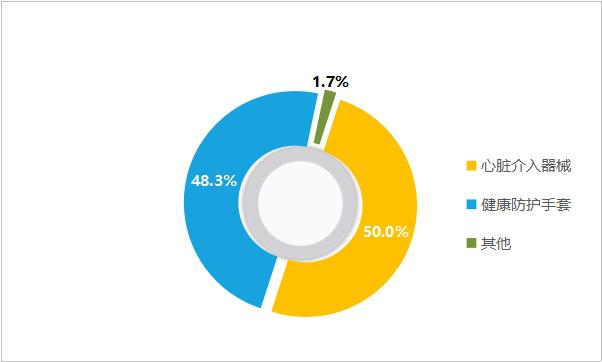

Cardiac stent, also known as coronary stent, is a high-value consumable commonly used in percutaneous coronary intervention (PCI), which has the function of dredging arterial blood vessels and is recognized as a conventional treatment for cardiovascular diseases. Since the first generation of stents went on the market in 1997, the development of cardiac stents has gone through three stages, the first generation is the balloon expansion era, the second generation is the bare metal stent era, the third era is the drug-eluting stent era, and it is now moving towards the fourth generation of completely degradable stents. With the continuous evolution of materials, the performance is more and more optimized. The main features of each generation of cardiac stents are as follows:

Fig. 1 development of cardiac stent

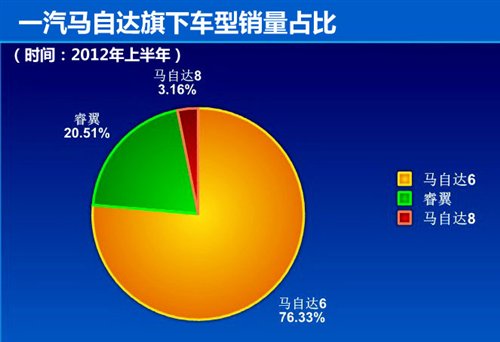

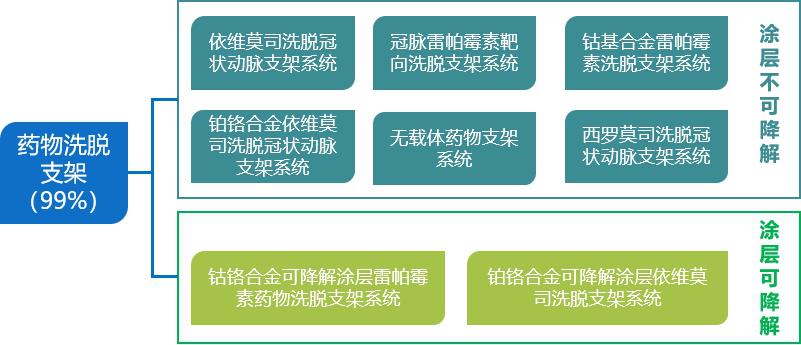

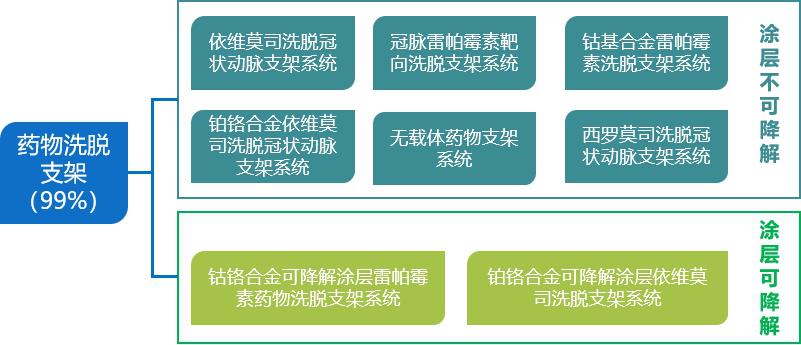

At present, non-degradable drug eluting stent,DES) is still the mainstream choice for clinical application, and fully degradable stent is still in the early stage of product development and clinical application. At present, the mainstream cardiac stents in the market are still drug-eluting stents, and the market share has remained at around 99% since 2012, and balloons and bare metal stents have been completely replaced by them. Biodegradable stents (BRS) can be gradually absorbed in the body, which can significantly reduce the formation of stent thrombosis and restenosis, at the same time, it will not affect MRI and CT scanning, and also facilitate the re-intervention process. It is the main direction of stent research and development in the world, and has attracted extensive attention from medical device companies at home and abroad. At present, the fully degradable heart stents put into research and development are mainly divided into two categories: degradable metal materials and degradable polymer materials.

Fig. 2 Types of mainstream cardiac stents currently in use

(A) In recent years, the demand for cardiac stents has been increasing, and the scale has steadily increased.

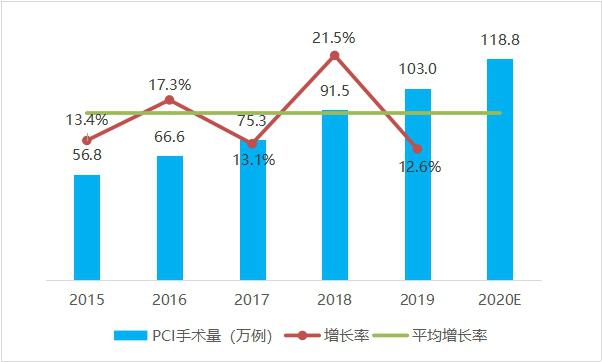

1. The number of PCI interventions in China ranks first in the world, and the number of PCI interventions has increased by over 15% annually in recent five years.

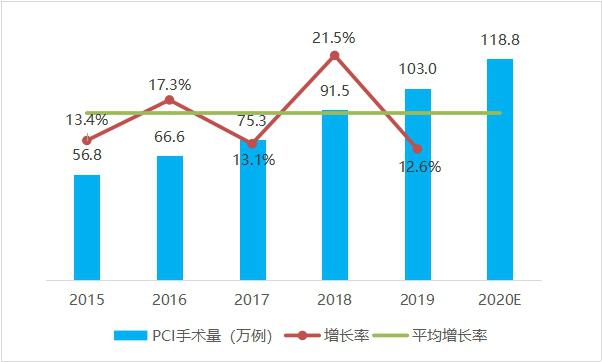

From 2015 to 2019, the number of cases of percutaneous coronary intervention (PCI) in China increased steadily, with an average annual increase of 16.0%. Among them, the number of percutaneous coronary intervention (PCI) in China in 2019 was 1.03 million, ranking first in the world, with an increase of 12.6% compared with 2018. It is conservatively estimated that there will be nearly 1.2 million cases of percutaneous coronary intervention (PCI) in China in 2020.

Fig. 3 Trends of PCI operation volume in China from 2015 to 2020 (data source: analysis by Health Research Institute).

In 2020, the market value of heart stents in China is close to 17.5 billion yuan.

From 2015 to 2019, the number of cardiac stents implanted in China showed a steady growth trend year by year, with an annual growth rate of 15%-20%. In 2019, the number of cardiac stents implanted in China was 1.6 million. In terms of market value, the market value of heart stents in China increased from 9.75 billion yuan to 15.97 billion yuan from 2015 to 2019, with an average annual growth rate of 15.2%. It is estimated that the market value will be close to 17.5 billion yuan in 2020.

Fig. 4 Trend chart of cardiac stent implantation quantity and scale in China from 2015 to 2020 (data source: analysis by Health Research Institute).

(B) The "market just needs+policy orientation+technology promotion" troika escorts the rapid development of the cardiac stent industry.

1. The market just needs:The two major trends of younger coronary heart disease and aging population have once again "expanded" the cardiac stent market.

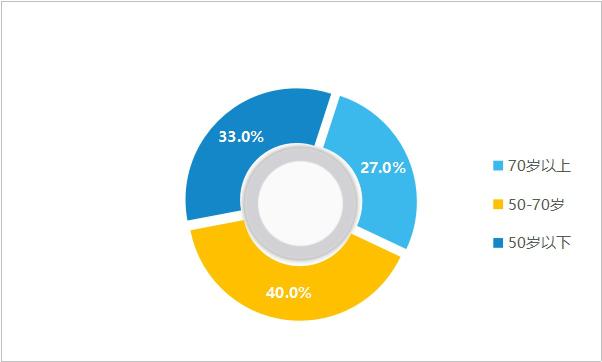

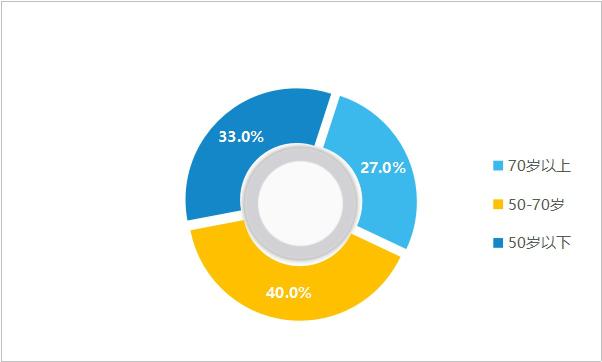

Younger coronary heart disease:Cardiovascular disease has become the number one health killer in the world, accounting for nearly 30% of the total global deaths. According to China Cardiovascular Health and Disease Report 2019, the number of cardiovascular patients in China reached 330 million, accounting for more than 45% of the deaths of residents, ranking first among all diseases. Among them, the number of patients with coronary heart disease has reached 11 million, with more than 3 million new patients each year and more than 1 million patients with sudden infarction. In addition, the younger trend of coronary heart disease (CHD) is increasing. According to a survey of cardiovascular diseases among more than 20,000 people in Shanghai, the number of patients with CHD accounts for nearly 30%, of which 27.0% are over 70 years old, 40.0% are 51-70 years old, and 33.0% are under 50 years old. CHD is no longer a "patent" for the elderly, and it is obese, stressful and stressful.

Figure 5 Proportion of cardiovascular disease population structure (data source: public information)

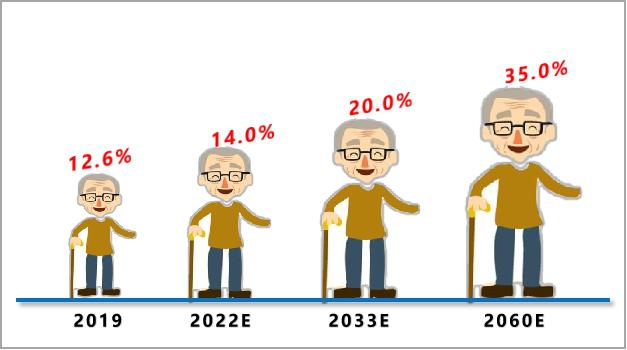

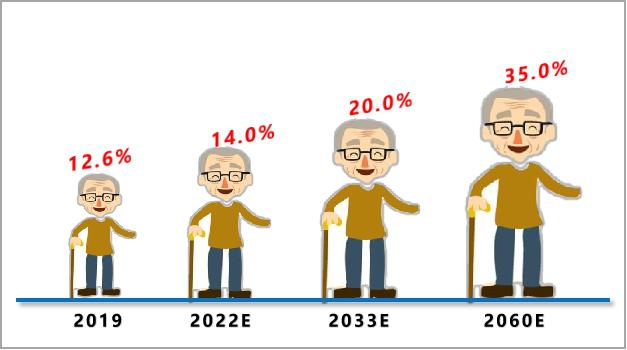

Aging:According to statistics, in 2019, the population aged 65 and above accounted for 12.6% in China. From the development trend, the population aging speed and scale in China are unprecedented. After 2022, China will enter a deeply aging society with a proportion of over 14.0%, a super aging society with a proportion of over 20.0% around 2033, and then it will continue to rise to 35.0% in 2060. The arrival of the era of deep aging will undoubtedly raise the "ceiling" of the heart stent industry.

Figure 6 Structural trend of population aging in China (data source: public information)

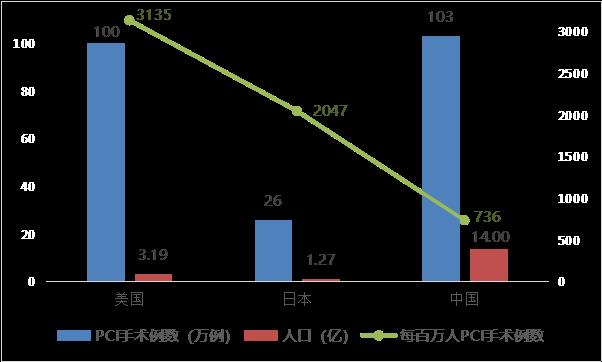

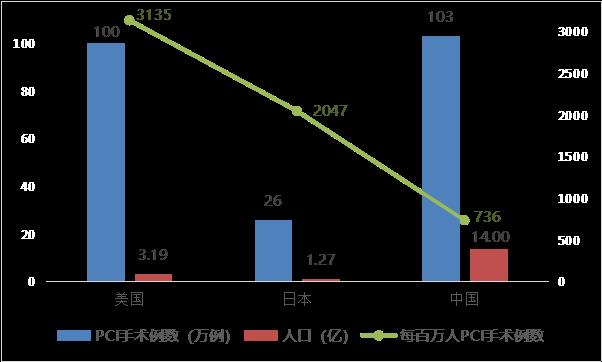

With the development of younger coronary heart disease and aging population, and considering the impact of centralized procurement on the price of cardiac stents and the improvement of people’s health awareness, the number of PCI operations per capita in China will be in line with that of developed countries in the future (the number of PCI operations per million population in China is 736, that in the United States is about 3,135, and that in Japan is about 2,047, which is 4.3 times and 2.8 times that in China, respectively). According to the extreme analogy method (referring to the number of PCI operations per million people in Japan, mainly considering that China and Japan are similar in race and incidence), it is estimated that the peak number of PCI operations will reach 2.87 million in the future. Considering the average number of stents implanted in PCI (about 1.5 stents/case), the corresponding peak number of cardiac stents implanted is about 4.3 million, which has a large long-term permeability and market space.

Fig. 7 Comparison of the number of percutaneous coronary intervention (PCI) between China and major developed countries (data source: analysis by Health Research Institute).

2. Policy orientation:Front-end encouraging innovation and end-collection specification help the market demand of cardiac stents to be released continuously.

In recent years, the state has launched a series of favorable policies for the medical device industry to support the rapid development of enterprises:

innovateEncourage the acceleration of the transformation and upgrading of medical devices, develop high-end interventional products such as fully degradable vascular stents, and stimulate the development of new cardiac stents market segments; Priority is given to the review and approval of qualified innovative medical devices. Under the promotion of innovation policy, the fully degradable polymer matrix drug (rapamycin) eluting stent system (NeoVas) independently developed by Lepu Medical and the fully degradable polylactic acid stent (Xinsorb) independently developed by Academician Ge Junbo of China Academy of Sciences have all entered the special approval procedures for innovative medical devices.

circulateFrom the national level to the provinces and cities, the centralized purchasing scheme of high-value consumables has been launched one after another, constantly rationalizing the price system of high-value medical consumables and improving the supervision and management of the whole process. In October 2020, coronary stents became the first batch of purchased varieties, and the national level started the collection of high-value medical consumables.

Table 1: Main policies related to high-value consumables such as cardiac stents from 2016 to present:

3. Technology promotion:The iterative upgrading of products and the improvement of interventional surgery level greatly enhance patients’ confidence and willingness to receive interventional therapy.

Iterative upgrade of products: cardiac stent has experienced the development from balloon expansion to drug-eluting stent, and the restenosis rate of stent implantation has decreased by nearly 20%, and the incidence of thrombosis in stent has decreased to about 1%, which effectively reduces the risk of complications for patients;

Improving the level of interventional surgery: China has successively established the training base of cardiovascular interventional diagnosis and treatment of the Ministry of Health and the national quality control center of PCI, and adopted a unified training model to carry out systematic training nationwide, and issued certificates after passing the examination, and carried out quality control and index monitoring on related work. In 2018, the mortality rate of interventional therapy for patients with coronary heart disease was 0.26%, far lower than that in the United States.

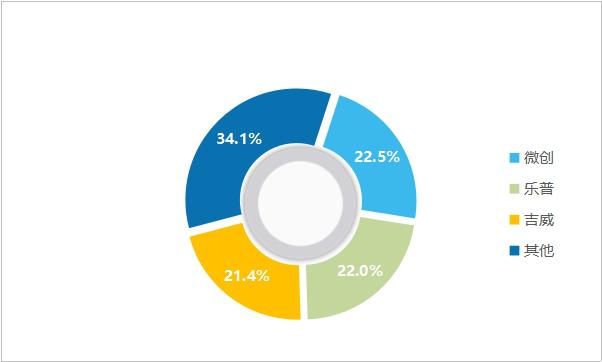

(III) Competition pattern: Domestic substitution in the cardiac stent industry has basically been completed.

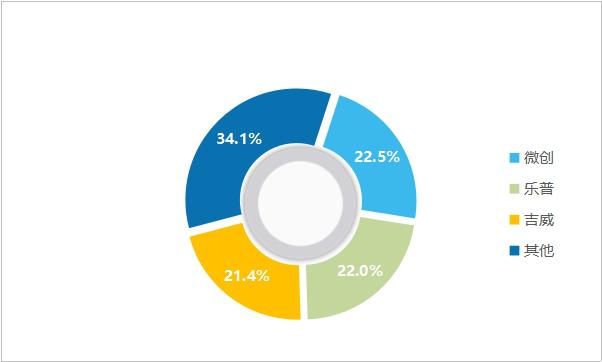

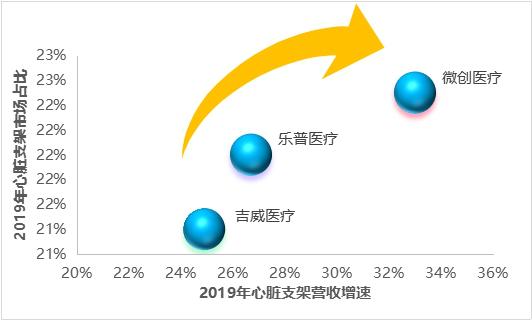

After decades of development, the technical generation gap among major enterprises has gradually narrowed, and the industry pattern has been basically stable, mainly relying on the launch of new products to enhance market share. Judging from the competition pattern, the concentration of cardiac stent industry is high, and the market share of domestic drug stent products exceeds 70%, and the domestic substitution is basically completed. Among them, domestic brands such as Weichuang, Lepu and Jiwei rank among the top three, with a total market share of over 65%.

Figure 8 Market share of domestic cardiac stent brands in 2019 (data source: analysis by Health Research Institute)

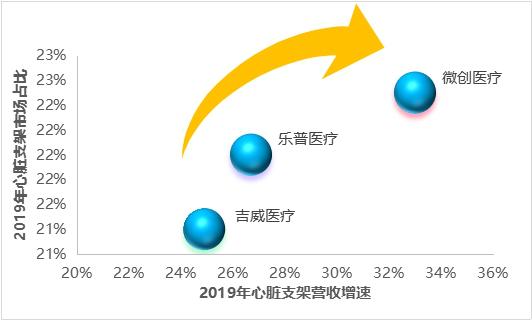

In 2019, the revenues of cardiac stents (including balloons, catheters and other ancillary products) of minimally invasive medical care, Lepu medical care and Jiwei medical care were 1.83 billion yuan, 1.79 billion yuan and 1.74 billion yuan respectively, with growth rates of 33.0%, 26.7% and 24.9% respectively. As can be seen from the figure, cardiac stents of minimally invasive medical care showed a trend of "double high" in sales growth rate and market share.

Figure 9 Market share and revenue growth rate of cardiac stent head enterprises (data source: analysis by Health Research Institute)

Change: the national "group purchase" triggered a major change in the heart stent industry.

With the landing of the national heart stent collection, the "suicide" price reduction of enterprises has also brought infinite reverie to the future direction of the industry. Will the heart stent industry under centralized procurement be a "broken wrist" or a "rescue" in the future? Is it "price for quantity" or "innovation and transformation"?

(A) the change in scale

Centralized procurement of cardiac stents directly affects the purchase price. According to the recent centralized purchasing list published by the Medical Insurance Bureau, the number of intentional purchases in the first year exceeded 1.07 million, involving 27 products. Based on the published average price quoted by the winning bidder (1682 yuan/piece) and the amount of coronary stents implanted in 2021, the market value in 2021 is about 3.19 billion yuan. It should be emphasized that the market value forecast here does not consider the impact of the decline in centralized purchasing price on the improvement of patients’ willingness to operate.

Fig. 10 Market value forecast of cardiac stent in 2021 (data source: analysis by Health Research Institute)

According to the previous estimation of the amount of cardiac stent implantation in China, when the amount of PCI operation per 100 people reaches the Japanese level, the peak amount of cardiac stent implantation in China is 1400 x 2047 x 1.5 = 4.3 million. According to the heart stent of 1682 yuan/piece (the average price of centralized procurement), the corresponding market value of heart stent is 7.23 billion yuan:

Fig. 11 Market value of China cardiac stent corresponding to peak value (data source: analysis by Health Research Institute)

From the above analysis, it can be seen that under the influence of centralized procurement policy, the market value of heart stents in China in the next 1-3 years is expected to be in the range of 3-7 billion yuan.

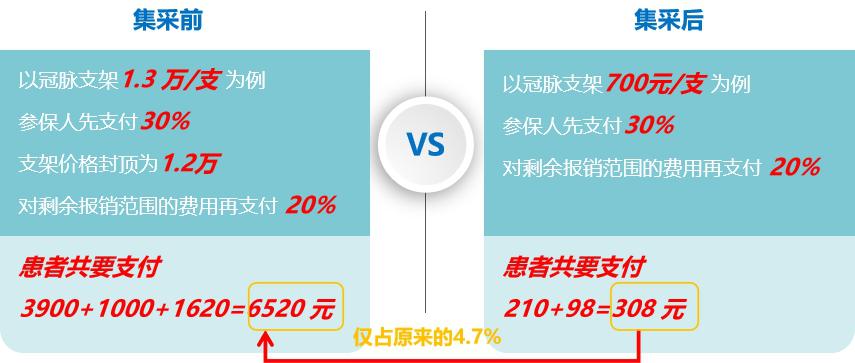

How much money can patients save after centralized collection?

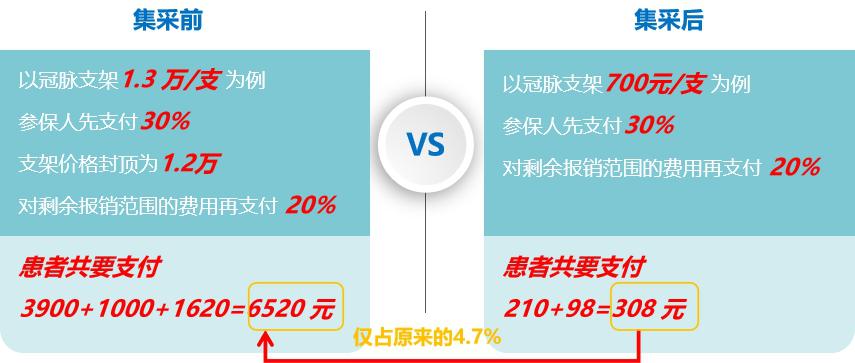

As we all know, the "floor price" of centralized purchasing has a great influence on patients who are unwilling to undergo interventional surgery because of the high price. This paper analyzes the payment situation of patients before and after centralized purchasing (according to the conventional reimbursement policy):

Fig. 12 Comparison of patients’ self-funded amount before and after centralized purchasing (data source: analysis by Health Research Institute)

As can be seen from the above figure, according to the same reimbursement policy, the out-of-pocket medical expenses of patients decreased from 6520 yuan to 308 yuan before and after centralized purchasing, and the personal burden was only 4.7% of the original, which greatly eased the economic burden.

(2) Changes in business

In addition to the industry scale being affected, the business tentacles of heart stent enterprises will also be adjusted:

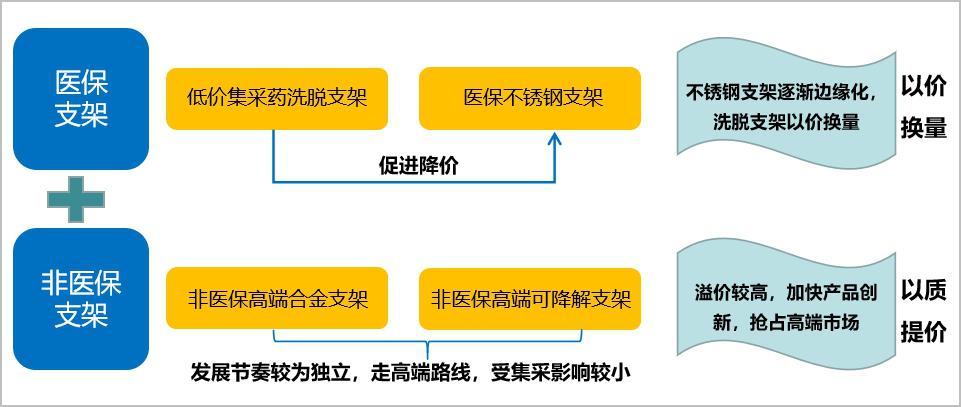

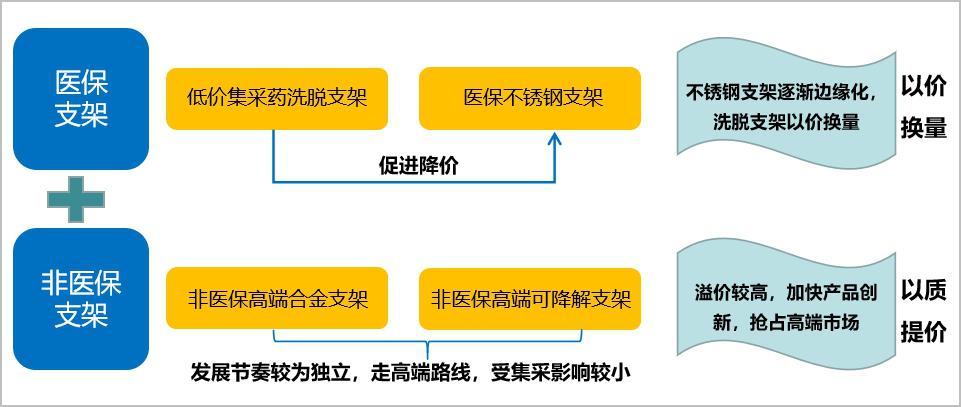

1. Stent market: form a low-cost medical insurance centralized procurement market+off-standard non-medical insurance high-end alloy stents+medical insurance stainless steel stents+non-medical insurance ultra-high-end degradable stents.

In the short term, the market of cardiac stent products will form a pattern of low-cost medical insurance centralized procurement market+off-standard non-medical insurance high-end alloy stent+medical insurance stainless steel stent+non-medical insurance ultra-high-end degradable stent:

On the one hand, from the current attitude of centralized mining, bare metal stents are not included in the list of centralized mining, and the price of stainless steel stents will be under pressure due to the price reduction of centralized mining in the short term, and the price inversion with alloy stents will not last long; In the long run, stainless steel stents are not as good as alloy stents in terms of support and passability. As a more backward technology than Co-Cr alloy and Pt-Cr alloy, stainless steel stents will face marginalization in the future. However, in view of the fact that the use of stainless steel coronary stents still accounts for about 40% of the market share in 2019, stainless steel coronary stents will be coasting for a period of time in the future.

On the other hand, with the continuous promotion of cardiac stent collection, the trend of differentiation and stratification of end patients will become more obvious, and the group of self-paid high-priced stents may expand. Degradable stents and metal stents belong to two price bands, so it is impossible to talk about the market share substitution after the huge change of centralized purchasing price. Moreover, the proportion of consumables in the cost of PCI surgery has further decreased, and the audience’s marginal willingness to pay for innovative products is likely to increase. In the medium term, the development rhythm of fully degradable stents will continue to be stable, in order to get as much clinical data as possible, enhance the recognition and acceptance of products by more experts, doctors and patients, and enhance the high-end market share.

Figure 13 Future product layout of cardiac stent

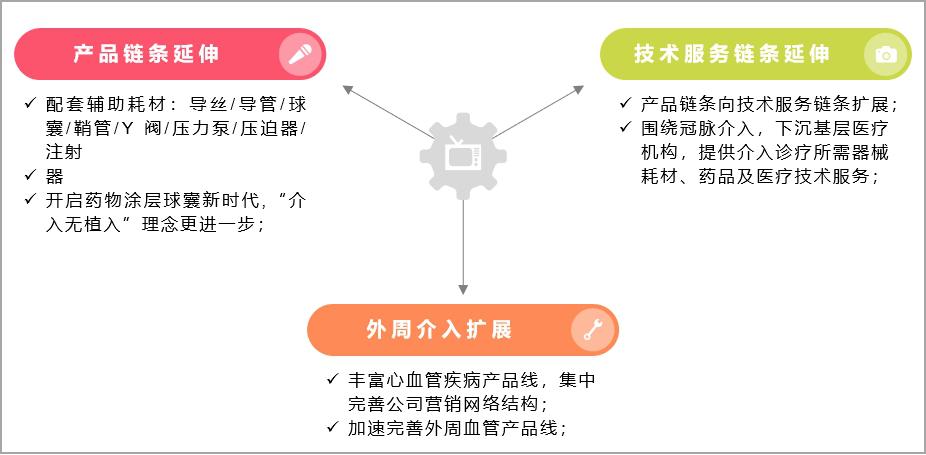

2. Business reshaping: cultivate and expand new medical formats around the cardiovascular field, and make a forward-looking and diversified layout.

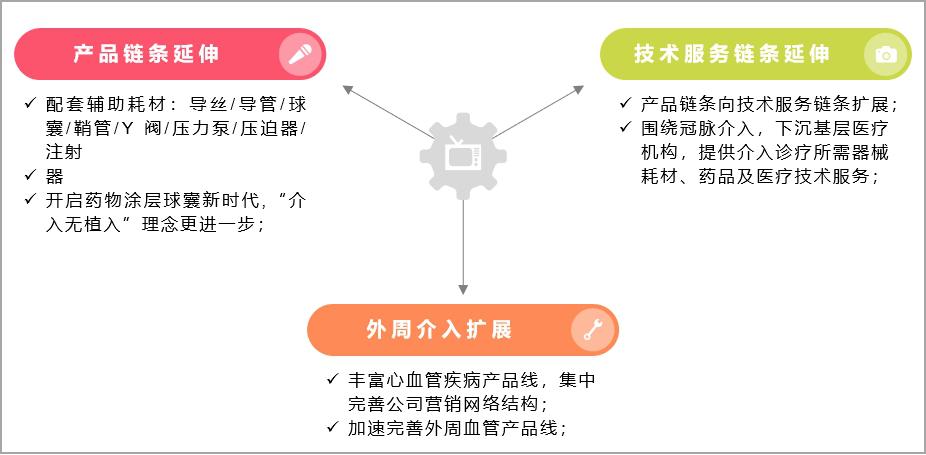

On the one hand, it conforms to the latest concept of "intervention without implantation" of the current interventional instruments, and extends upstream and downstream around the coronary intervention chain:

Product chain: the price reduction of metal stents will be the norm in the future, and the fully degradable stents and drug balloons with "intervention without implantation" will become the core of future development. Facing the policy impact of centralized stent mining, it will be an effective hedging means to extend the layout of coronary intervention chain. In addition to completely degradable stents, a new generation of drug-coated balloon (DCB) has also become the core of future development under the new concept of "interventional non-implantation". The data shows that the usage of drug-coated balloons in some hospitals or individuals in Europe has reached 50%-90% of all PCI, and Japan has reached 4,000 per month, accounting for about 15% of Japanese PCI. In addition, auxiliary consumables (balloons, catheters, guide wires, etc.) related to coronary intervention will also become the profit growth point that enterprises pay attention to.

Technical service chain: The further decline in the proportion of consumables in the cost of PCI surgery has prompted enterprises to speed up the layout of medical services and health management sectors. Conditional enterprises will cooperate with primary hospitals to provide equipment consumables, drugs and medical technical services needed for interventional diagnosis and treatment, and promote the grassroots promotion and popularization of new interventional technologies, which will become an important exploration for coronary intervention enterprises to face the centralized procurement of high-value consumables.

On the other hand, the centralized procurement of cardiac stents has prompted enterprises to expand from coronary intervention to peripheral intervention, and continuously enrich their product lines:

Make full use of enterprise stent balloon design and precision manufacturing platform technology, constantly innovate and develop, expand the company’s products from coronary intervention to peripheral intervention, continuously enrich the cardiovascular disease product line, and concentrate on improving the company’s marketing network structure to cope with market risks brought about by policy uncertainty.

Figure 14 Possible business development direction of cardiac stent enterprises under the background of centralized procurement

(C) changes in the market

Under the general trend and background of medical insurance fee control and national centralized procurement, it has a great influence on the competition pattern of domestic medical industry. Medical device enterprises will face more fierce market competition, as well as the realistic problems of product prices and product profit margins falling sharply. For the leading enterprises in the industry, although they can seize more market share by winning the bid at a low price, the problem of shrinking scale and declining profit rate cannot be underestimated.

In the foreseeable future, the scope of domestic medical insurance control fees will only increase, so as to more effectively reduce the pressure of medical insurance expenditure, reduce the prices of drugs and devices and benefit the people’s livelihood. In addition, the situation in the field of devices may appear in the previous pharmaceutical field, and importers may take more aggressive quotations to seize the domestic market after they are familiar with the rules.

For domestic cardiac stent enterprises, facing the policy risks of centralized procurement and medical insurance control, they need to seize the domestic share, turn their attention to the international market and participate in the international market competition. In fact, domestic heart stent head enterprises have also started the international strategic layout, among which minimally invasive medical care, Lepu medical care and Lan Fan medical care are typical representatives.

Turn: Transforming into a strategic choice for heart stent enterprises to overtake in corners.

In the face of major changes in the national medical device policy, cardiac stent enterprises actively predict the development trend, plan ahead, and focus on developing products and new businesses related to centralized procurement while strengthening product technology innovation. For domestic heart stent enterprises, what transformation layouts have been made at present? What is the possible key direction of development in the future?

(1) Adjust the business strategic map and form a multi-sector support system.

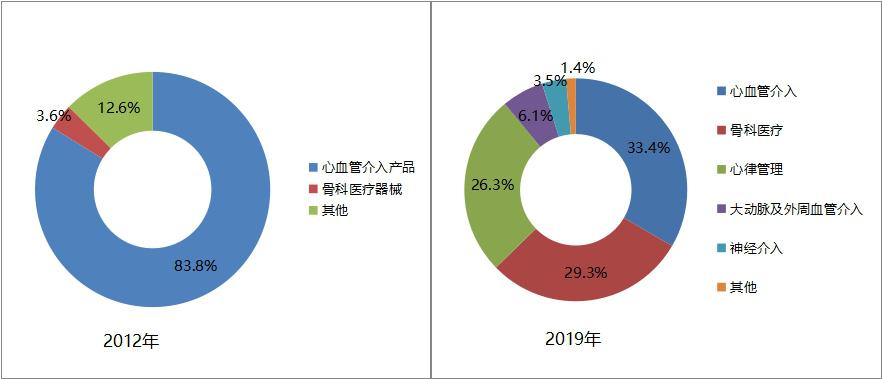

1. Diversification of business lines-minimally invasive medical treatment

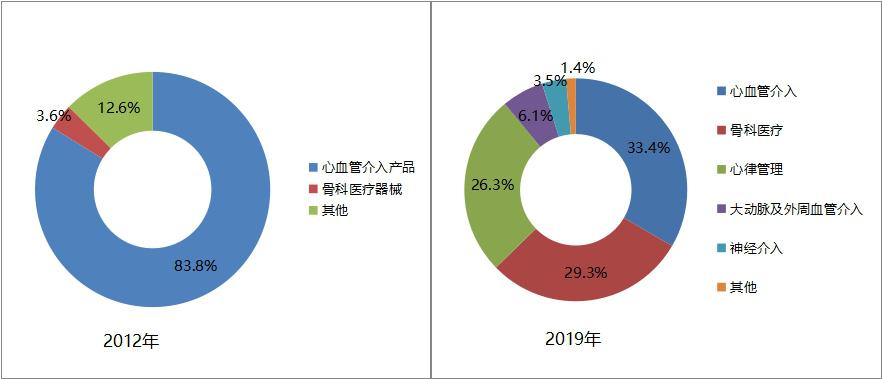

Through business diversification, we will continuously broaden profit points and enhance comprehensive competitiveness. In recent years, Minimally Invasive Medical Devices Co., Ltd. (hereinafter referred to as "Minimally Invasive Medical") has continuously enriched its product line and expanded its business field through outreach acquisition and endogenous development. Products gradually changed from early cardiovascular stents to diversified business systems covering cardiovascular intervention, orthopedic medical devices, heart rate management (pacemaker), arterial and peripheral vascular intervention, and nerve intervention products.

In 2019, the business revenue was 5.55 billion yuan, of which 33.4% came from cardiovascular interventional products, 29.3% from orthopedic medical devices, 26.3% from heart rhythm management business, 6.1% from arterial and peripheral vascular interventional products, and 3.5% from neurological interventional products. In 2012, the revenue of minimally invasive medical cardiovascular interventional products (stents) accounted for 83.8%.

Figure 15 Comparison of the proportion of minimally invasive medical business segments in 2012 and 2019 (data source: minimally invasive medical annual report)

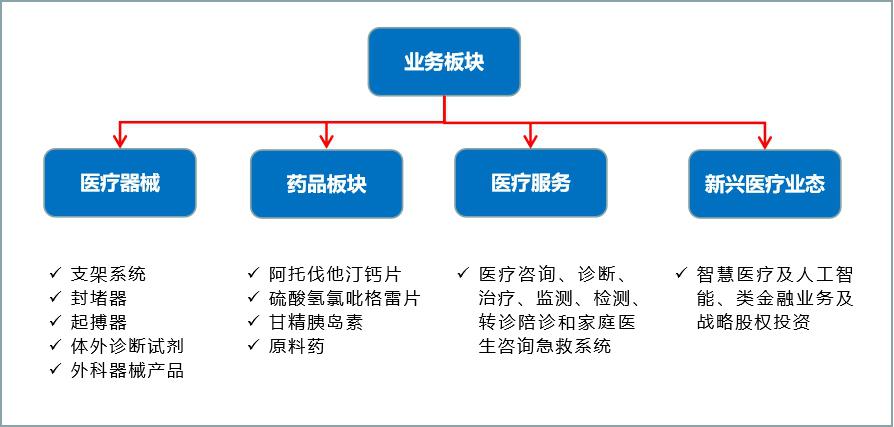

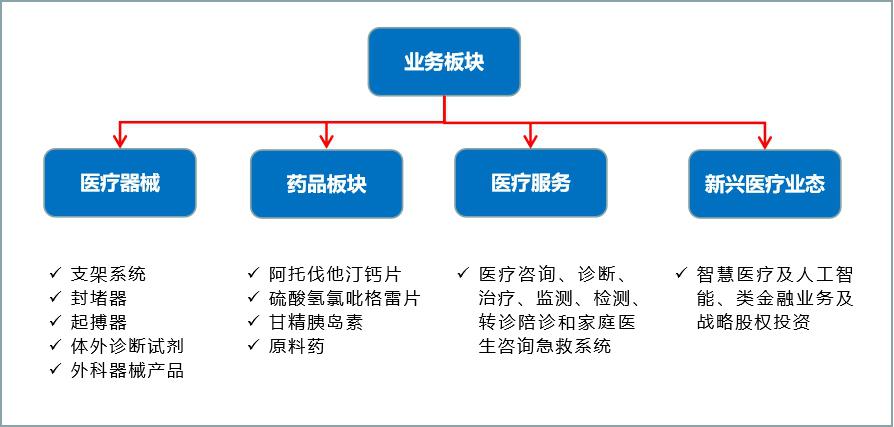

2. Product line "from one to four", and build a platform business model of "equipment+medicine+medical service+new medical care"-Lepu Medical.

Lepu (Beijing) Medical Devices Co., Ltd. (hereinafter referred to as "Lepu Medical"), as one of the earlier enterprises engaged in the research and development of cardiovascular interventional medical devices in China, has been accelerating the business integration, optimization and layout in recent years, and has developed from a single stent business in 2013 to four business segments covering "devices+drugs+medical services+new medical care" at present, with the goal of building a platform-based business model around the whole life cycle service for cardiovascular patients.

Figure 16 Main contents of each business segment of Lepu Medical

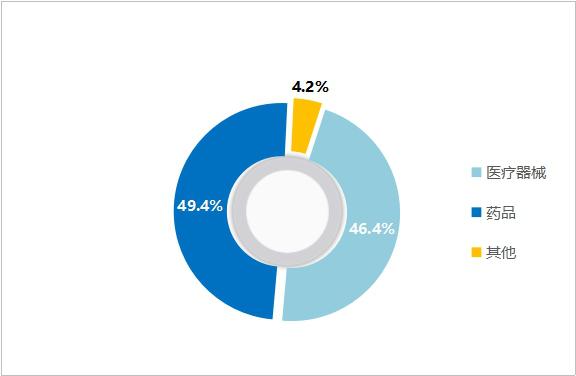

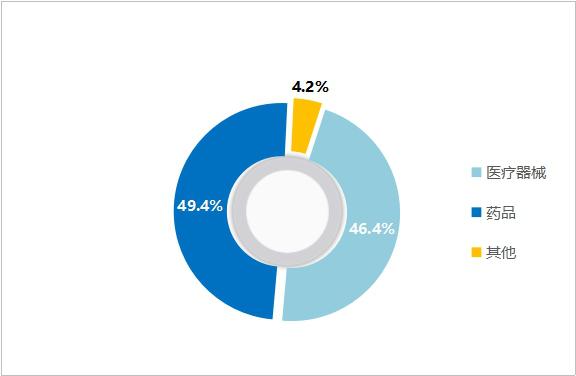

Dual track of medical devices and medicines: In terms of revenue, the revenue of Lepu Medical in 2019 was 7.80 billion yuan, a year-on-year increase of 22.6%. Among them, the medical device sector achieved operating income of 3.62 billion yuan, accounting for 46.4%, and the pharmaceutical sector achieved revenue of 38.5%, accounting for 49.4%. Among them, the revenue of coronary stent system only accounts for 20% of the total revenue of Lepu Medical. In addition, the market share of the company will be directly increased after winning the bid, and the negative impact of centralized procurement is relatively limited.

Figure 17 Revenue Ratio of Lepu Medical in 2019 (Source: Lepu Medical Annual Report)

3. "Health protection+medical equipment" two-wheel drive-Lan Fan Medical

Lan Fan Medical Co., Ltd. (hereinafter referred to as "Lan Fan Medical") is a leading enterprise in the field of medical gloves in the world, accounting for 22% of the global market. In 2018, it successfully acquired the fourth-ranked cardiac stent company in the world, Singapore Baisheng International Group, and realized its layout in the field of medical devices. Subsequently, Lan Fan Medical implemented the "A+X" industrial strategy, and set up four business divisions with a total of seven tracks:

Figure 18 Layout of Lan Fan Medical Industry

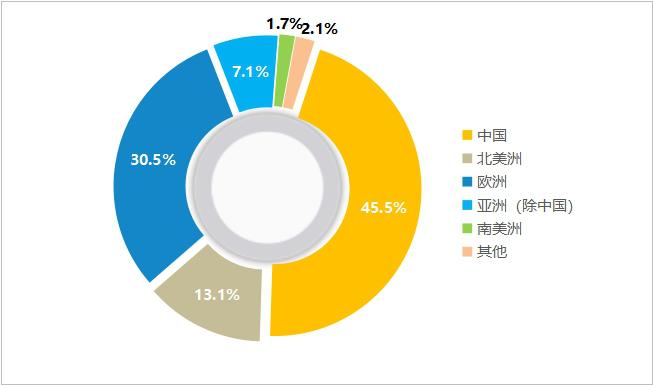

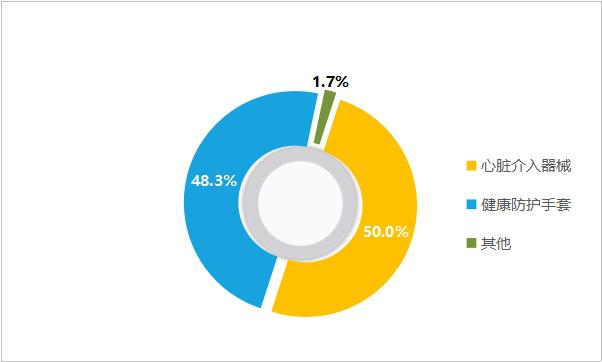

At present, Lan Fan Medical has two business series products, namely health protective gloves and heart stents, which are continuously extended to the whole chain of emergency care, cardiovascular and cerebrovascular diseases, forming a multi-business sector collaborative model combining low-value, medium-value and high-value consumables products, with complementary modes and risk hedging. In 2019, Lan Fan Medical achieved a revenue of 3.48 billion yuan, of which the revenue of health protective gloves was 1.68 billion yuan, accounting for 48.3%, and the revenue of cardiac interventional devices (including self-produced and agents) was 1.74 billion yuan, accounting for 50.0%.

Figure 19 Revenue Ratio of Lan Fan Medical in 2019 (Source: Lan Fan Medical Annual Report)

(2) Expand the cardiovascular product chain and form a diversified ecological closed loop.

1. Strategic positioning of big heart-minimally invasive medical treatment

Based on its own existing technology and platform, minimally invasive medical care constantly lays out big heart tracks: coronary heart disease, arrhythmia, structural heart disease and heart failure.

Development contextMinimally invasive medical care started from coronary stent, then cut into radiofrequency ablation, and then extended to pacemaker business. Later, with the further development of interventional technology, structural heart disease entered the era of minimally invasive surgery, and minimally invasive medical care opened up the technical path of completing heart valve replacement by interventional method (representative product VitaFlow transcatheter aortic valve system). Compared with these business units with mature products, Minimally Invasive has begun to "plan the layout" of the treatment solution for heart failure, which is also an important pawn for the future layout of Minimally Invasive and the key to completing the closed loop of the big heart business.

2. Optimize iterative coronary medical devices, enrich and innovate the implantable product line-Lepu Medical.

Lepu Medical has built a rich product group of devices in the cardiovascular field:

1) Accelerate the industrial chain matching of coronary intervention devices. In 2019, Lepu medical coronary stent products achieved operating income of 1.53 billion yuan, a year-on-year increase of 23.3%; Supporting auxiliary consumables (balloon catheter, guide wire, etc.) realized an operating income of 260 million yuan, up 51.0% year-on-year. Under the background that most of the auxiliary PCI interventional materials such as balloon catheter guide wire are monopolized by foreign capital, Lepu Medical is the only R&D and manufacturing enterprise in China that can provide all the consumables for coronary intervention. At present, more than ten necessary consumables such as pre-expanded and post-expanded balloon catheter, PTCA guide wire, guide catheter, contrast guide wire, contrast catheter, sheath, Y valve, triple tee, pressure extension tube, pressure pump, ring handle syringe, pressure sensor and hemostasis compressor have all been mass-produced.

2) Coronary balloon products and NeoVas bioabsorbable stents are expected to form new growth points. In February 2019, NeoVas, an international second-generation bioabsorbable drug stent independently developed by Lepu Medical, was approved for listing in China, and opened a new era of PCI technology "intervention without implantation". In July 2019, the first-generation coronary balloon was approved by GMP for the first time. Three products of the second-generation drug balloon series are about to start clinical trials, and the third-generation rapamycin drug balloon technology has made breakthrough progress, and animal experiments will be carried out soon.

In addition, in recent years, Lepu has actively developed peripheral products of degradable and drug balloons based on the Group’s coronary stent and balloon platform technology, and its business scope has expanded from coronary intervention to peripheral intervention.

3. Layout of coronary artery, valve, nerve intervention and peripheral intervention-Lan Fan Medical.

At the time when the medical device industry entered the golden period of development, Lan Fan Medical continuously accelerated the overall layout of cardiovascular and cerebrovascular devices based on the leading edge of Baisheng International Cardiology Department:

In the field of coronary intervention: all kinds of stent products produced by Singapore Baisheng International are sold to more than 90 countries and regions around the world, with a sales volume of 400,000. At present, BioFreedom, a drug-coated stent of BA9? without polymer carrier, has been introduced into European and Japanese markets, and it is expected to be listed in the United States and China in the near future. From the perspective of stent technology, the upgrading of technology is still the theme of stent industry and the driving force of sales growth. The increase in the proportion of high-end stents such as BioFreedom and Excrossal, as well as the development of foreign markets, have helped to enter the new product bonus period. In addition, taking the cardiac stent as the fulcrum, we will enrich, expand and improve the product line combination related to PCI surgery, such as contrast guide wire, contrast catheter, guide wire, guide catheter, pre-expanded balloon, post-expanded balloon, puncture needle, arterial sheath and pressure extension tube.

Cardiovascular related product lines: Apart from coronary artery, valve, nerve intervention and peripheral intervention are also the tracks that Lan Fan Medical keeps cutting in. By continuously expanding and expanding related product lines such as valve, nerve intervention, peripheral intervention and drug balloon, the competitiveness of product portfolio will be enhanced. The capital is undoubtedly the quickest way for Lan Fan Medical to broaden the track. In June, 2020, Lan Fan Medical acquired the fifth manufacturer of TAVR in the European market. NVT’s main business is the research and development, production and sales of interventional valves for structural heart disease. Through the acquisition of TAVR, a gold track for medical devices, NVT officially entered the field of minimally invasive interventional structural heart disease therapy with broad prospects.

(C) the implementation of internationalization strategy to enhance the international market share of products.

1. Actively deploy the global mainstream market-minimally invasive medical care.

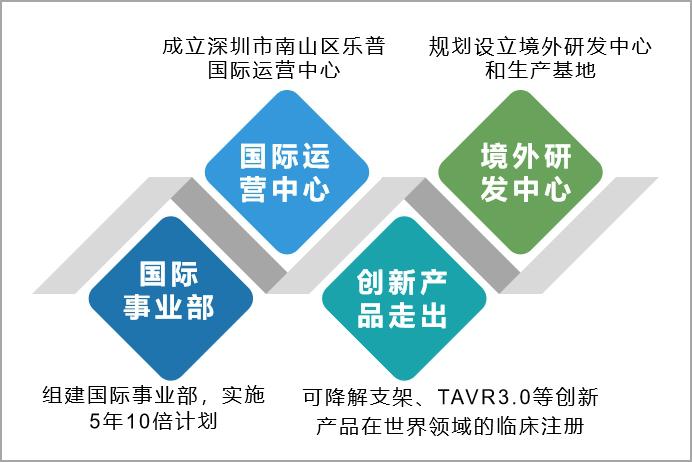

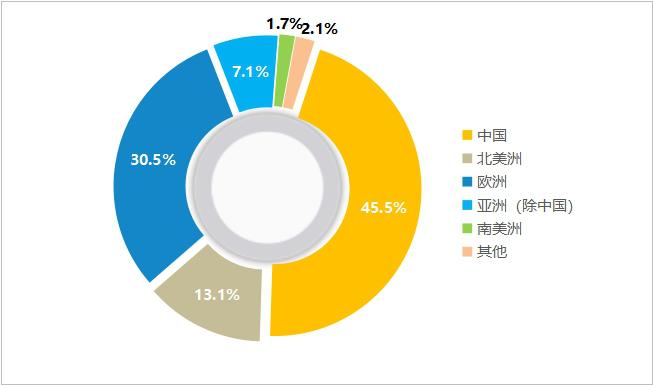

Since 2014, minimally invasive medical care has set its sights on overseas and accelerated the export of China native coronary stents to overseas markets. In 2019, the overseas business of minimally invasive medical drug-eluting stents achieved revenue of 160 million yuan, a year-on-year increase of 72.4%. Sales in 25 countries or regions and registration certificates in 13 countries or regions. Among them, Firebird2TM’s overseas revenue increased by 186.9% year-on-year, FirehawkTM’s revenue increased by 54.6% year-on-year, and it has been sold in several major European countries. In addition, the group has also submitted the application for registration of FirehawkTM stent to the Japanese medical device review and approval authority, and actively deployed the global mainstream market.

Figure 20 Sub-regional Income Ratio of Minimally Invasive Medical Care in 2019 (Source: Minimally Invasive Medical Annual Report)

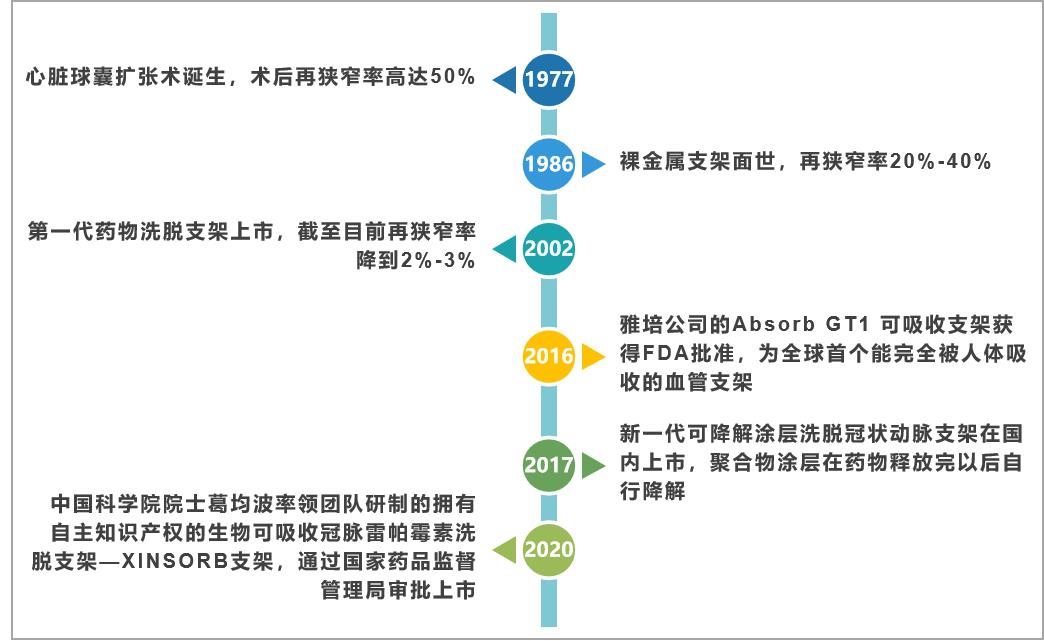

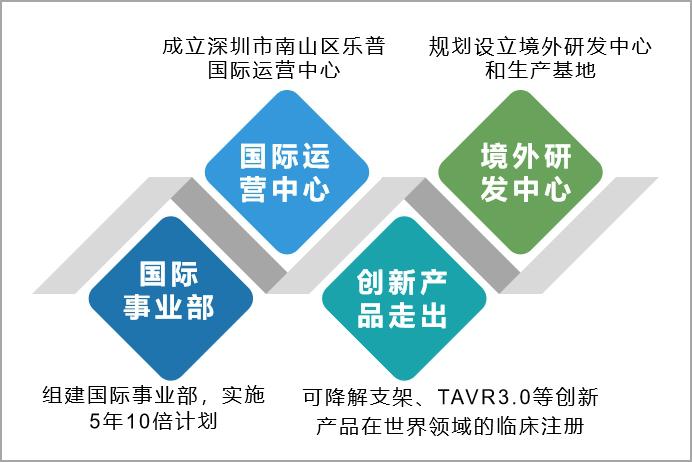

2. Establish an international business department to increase the market share of international innovative products-Lepu Medical.

Lepu Medical put internationalization on the agenda after the first round of domestic drug collection in 2018, and proposed to further increase the market share of international innovative products. At present, the original foreign trade business and departments of all subsidiaries have been integrated, and the international business department has been established to strengthen the international influence on the upstream and downstream of the medical industry chain in the cardiovascular field. Explore the possibility of setting up R&D centers and production bases overseas. Overseas R&D centers have been planned to accelerate the clinical registration of innovative products (degradable stents, TAVR3.0, renal artery ablation, artificial intelligence ECG and artificial intelligence monitoring) in the world.

It is reported that Lepu Medical’s business revenue from abroad in the first half of 2020 was 870 million yuan, an increase of 320 million yuan compared with the whole year of 2019. Guo Tongjun, senior deputy general manager and secretary of the board of directors of Lepu Medical, said at the reception of listed companies that the company’s overseas market target remains unchanged, and the proportion of overseas market revenue will continue to increase to 20%-30% in the next 3-5 years.

Figure 21 Lepu Medical Internationalization Strategic Measures

summarize

National centralized procurement is not only a reshuffle of the cardiac stent industry, but also an impetus to the cardiovascular segmentation field. Heart stent enterprises still have a long way to go, but whether they are facing the "change" of the industry calmly or actively responding to the "turn" of the industry, there are undoubtedly two ways to go: First, strengthen the technological innovation and product iteration of heart stents in order to obtain new user markets; The second is to realize business diversification and risk hedging with the heart stent as the fulcrum.