Shi Yang (right) uses toys to attract the attention of hearing-impaired children.

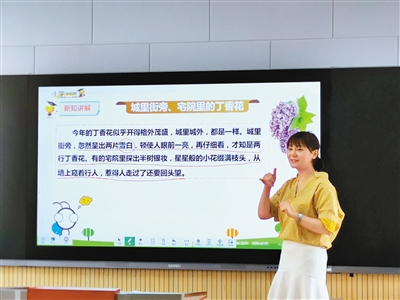

Liu Fang teaches students in sign language.

Zhang Yi gives instructions to the students.

Xia Hao’s students are studying in the classroom.

In the special education industry, students are generally called "angels with broken wings" because of physical defects. These children can’t hear the sound of the world or see the colors of blue sky and white clouds. Fortunately, there is such a group of people who have knocked on the hearts of children with love and persistence year after year. They may rarely feel the sense of accomplishment of "peaches and plums are all over the world", and what makes them happy is nothing more than the students making their first sound, knowing a new word and mastering a life skill … … They have a common name: special education teacher.

On the eve of Teacher’s Day, the reporter of Xi ‘an Evening News invited some citizens’ representatives to enter the world of special education teachers in primary schools, middle schools, universities and other places, and experience the "one day of special education teachers", showing the original ecology of special education teachers’ work and life, and experiencing their different teaching and unknown ups and downs.

Shi Yang, a language training teacher for children’s rehabilitation — —

A guide for hearing-impaired children at the beginning of their lives

"Where are the little cat’s eyes? Xuan’s eyes blink. " On the morning of September 6, in the classroom of the Rehabilitation Training Center of the Second School for the Deaf in Xi ‘an, Shi Yang, a rehabilitation language training teacher, was giving a parent-child class to the hearing-impaired child Xuan (a pseudonym) and Xuan’s mother. Xuan Xuan, 1 year and 7 months old, is a little angel whose ears are covered by God. She was screened for hearing impairment at birth and was diagnosed deaf six months later.

Shi Yang played a game with a kitten toy to attract her attention. There are also many toys and audio, triangle iron, drums and other vocal AIDS covered with cloth around her. Shi Yang said that normal children can hear voices when their mothers are pregnant, and hearing-impaired children have adapted to the silent world when they are diagnosed again at birth. Even if you wear hearing AIDS, you should start training as soon as possible, so that children can hear and perceive sounds and their corresponding things, and finally learn to make sounds.

"Rehabilitation training is the enlightenment point of hearing-impaired children, the first step to create possibilities and hopes for them, and an extremely important step. If the effect is good, hearing-impaired children can speak normally." Shi Yang said that more and more parents are aware of this and take their hearing-impaired children to language training as soon as possible. The youngest student in the rehabilitation training center this year is only one year and one month.

Because the students are young and can’t sit in the classroom and concentrate on training, Shi Yang can only attract his attention with toys. In class, when she cried, she sang children’s songs, and she made a lot of noise. She had to stop the class and play with her. Sometimes she would climb everywhere, and Shi Yang would climb all over the classroom.

"Try not to let the child see the mouth shape, let her listen to the voice more, the child has strong imitation ability, and can’t talk frequently." After training Xuan’s listening comprehension, Shi Yang will also give guidance to Xuan’s mother and demonstrate that Xuan’s mother can also train her children correctly at home.

Unlike other teachers in class, the students are young, and Shi Yang needs to sit cross-legged on the mat for class. After a class, her legs are all red, and when she stands up, she almost loses her footing. Just after seeing Xuan off, another pair of parents and children who had a parent-child class walked into the classroom again.

"I never feel tired. I have seen too many children open their mouths for the first time ‘ Mom ’ The scene has also seen many children successfully get out of school after recovery, which is the best reward for me. " Shi Yang said that she has always had a dream that all deaf-mute children can enter ordinary schools. Only deaf-mute children without deaf-mutes is her never-ending goal.

Citizen representative experience

"The first time I saw a class for such a small deaf-mute child, it was not easy for Teacher Shi to climb over and interact with the students." After a rehabilitation language training class, Li Hao, a citizen representative, was deeply touched. In his view, scientific correction and early intervention are important missions of special education, and special education teachers play an irreplaceable role in these two aspects.

"Teachers use professionalism and patience to care for special children and help them integrate into society. The special education teacher represented by Shi Yang is the guider of special children in the early life, and interprets the significance of rehabilitation education with professional spirit. "

— — Li Hao (a graduate student who lives in Zhonghai Guanyuan Community on Qujiang Avenue)

Liu Fang, a Chinese teacher in a deaf-mute school — —

Help children build logical relationships word by word.

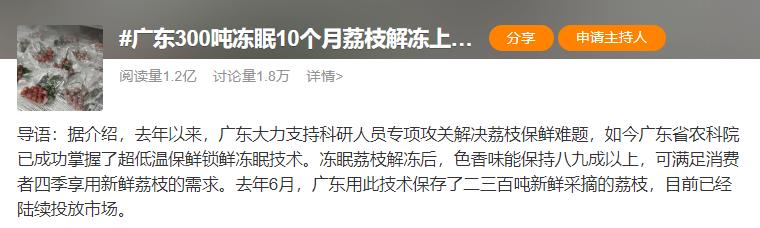

"This year’s lilacs seem to be particularly lush, both inside and outside the city … …” As soon as I entered the teaching building of the Second School for the Deaf in Xi ‘an, I heard the sound of reading with unclear words, which was completely different from the imagined silent classroom.

These reading sounds were read by nine deaf-mute students in grade seven, who used sixth-grade textbooks from ordinary schools. Liu Fang, a Chinese teacher, stood on the podium and led the students to read aloud together. In order to let the students see the mouth shape of pronunciation clearly, she tried to read every word fully, even exaggerating, and commanded up and down with one hand following the tone.

Liu Fang took the students to read the passage of nearly 100 words for three times, and asked two children to go on stage to sketch sentences describing lilacs. After the whole class, only two paragraphs of the six natural paragraphs were spoken. Liu Fang said: "I have taught them the words in the text in one class the day before. It takes at least four or five classes to finish a text."

Liu Fang said that because of the lack of language environment, deaf-mute children are prone to problems of disordered word order and unreasonable logic, and their language use ability is very poor. Writing articles is just keeping a running account. In order to help students establish logical relations, straighten out word order and make better use of words, she can only lead students to read and help them understand again and again, so as to achieve the point where practice makes perfect.

There is a timetable on the back wall of the classroom, in which Chinese and math classes account for most, and most of them are connected with two identical courses. Liu Fang said that one class can only talk for a short period, and only two consecutive classes can finish one class. "The Chinese class in the compulsory section is an important step to help deaf children establish a logical relationship, and they dare not relax."

Exaggerated oral expression and standard sign language movements, in order to attract students’ attention, she kept walking in the classroom. After two classes, Liu Fang’s voice was a little hoarse. She put her hand on the podium and said "goodbye" to the students with a smile.

Liu Fang said with a smile that these special children are as keen as radar. Once, they were in a bad mood. Although they tried their best to hide their emotions, they were discovered by the children. "Teacher, are you in a bad mood? Don’t feel bad. " Liu Fang, who was in class, was interrupted by students. A simple and unclear sentence made her surprised and moved. Since then, her face has been full of smiles every day in class. "No matter how tired I am, I can’t show it. I hope I am a person with light in my heart, illuminating the children’s world with my own light and making them feel warm."

In her seven years as a teacher, Liu Fang received flowers from students for the first time the year before last. "I clearly remember that it was a red carnation wrapped in white plastic paper with purple dots on it." Liu Fang’s eyes are a little wet. She said that if she can make a wish, she hopes that the children can make a little progress every day, and with the help of teachers and parents, they can master life skills and live independently when they leave campus. This is her most anticipated Teacher’s Day gift.

Citizen representative experience

"The Chinese class for deaf-mute children is like this. The teacher is too hard." Mr. Zhong, a college teacher who lives in Furong West Road, was very emotional after experiencing a Chinese class for special children. "Teachers should not only tell the children the content of the course loudly, but also do sign language at the same time, so that the children can understand the content of the article from two aspects: sound and movement."

Zhong Yibo said: "When Mr. Liu Fang speaks every word, she will guide the children to pronounce a tone close to the correct pronunciation through the combination of pronunciation skills and sign language, which is not easy compared with giving lessons to ordinary children."

— — Zhong Yibo (college teacher)

Zhang Yi and Wang Shuai, football coaches of blind and dumb schools — —

One-armed teachers form blind football teams.

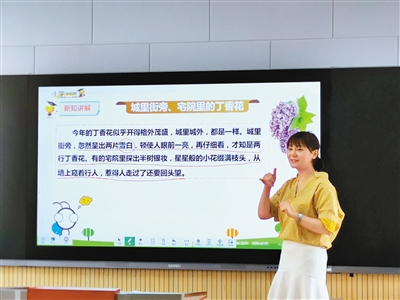

"Wu Jiacheng, stop first, the left shoelace is open." On the afternoon of September 6th, the newly formed football team of Xi ‘an School for the Blind and Dumb gathered on the playground. Coach Wang Shuai saw a student’s shoelaces open and squatted on the ground to help him tie them. Another coach, Zhang Yi, stood in the front row, followed by other students, hand in hand, standing in front of the goal about 80 meters away.

Wang Shuai guarded the goal, shouted "Go", and threw a football with bells inside, which could make a sound. A student opposite waved his arm and moved in the direction of the sound. The little football hovered between the students’ left and right feet and moved in the direction of the goal. Just a few steps later, the football was "lost", and the students looked half-faced, followed the sound of the bell, and then went to get the ball back.

This is a special team. The players are a group of blind children. Wang Shuai, who was guarding the goal, kept shouting "Hey, hey, hey" while clapping to guide the students. The student got up the courage to kick and the ball scored, but the child who didn’t know the shooting situation still stood where he started. "The goal is great. Go back to the queue." Only after Wang Shuai gave the student an affirmation did the student happily run back to the queue.

"Pay attention to pressing down the center of gravity and swing your arms naturally." Zhang Yi, the coach of the team leader across the goal, has been observing the movements of each student and then correcting them one by one. Zhang Yi has been a coach at school for 22 years. Before he came to school, he lost his left arm in an accident. As a computer teacher, he happened to see students kicking plastic bottles and asked them what they were doing. The student replied that he was playing football, which made him feel the students’ desire for sports, so he formed a football team. The newly formed team, with a total of 13 people, has just started the training of basic movements. Every movement should be demonstrated to let the children feel and learn, and then bend down to straighten their movements one by one. A team needs to train for at least one and a half years to make all the players run with the ball without dropping it. To reach the level of completing the game, it needs to train for at least three years.

Wang Shuai has been a coach for 19 years. When it comes to the preliminaries, he and Zhang Yi practice with their students for more than ten hours every day. Referring to these years of training, Wang Shuai said frankly: "Tiredness is certain, but we have the motivation to persist." Today, Li Yu, a professional athlete of Liaoning province’s football team for the blind, used to be a student of a school for the blind and dumb.

Zhang Yi believes that blind feet can not only help children get rid of blindness, but also enhance their physical fitness and improve their self-confidence and ability to live. "The world running in the sun is bright, and it is our greatest comfort to see their progress."

Citizen representative experience

"I can’t walk with my blindfold on, let alone play football. Blind students play too well. " After watching the training organized by Zhang Yi and Wang Shuai, Bai Yang, a citizen representative, expressed his deep respect for the two teachers. Bai Yang said that it was touching that Mr. Wang Shuai carefully examined the details of each child’s shoelaces before the training began. Teacher Zhang Yi has only one arm, and can also guide and lead blind students to run and play football on the playground. "We can’t imagine teaching blind students to play football, but the two teachers really did it." — — Bai Yang (employee of a bank in Keji Road, High-tech Zone)

Xia Hao, the head teacher of senior three in the school for the blind and dumb — —

Guide students to "touch" the beauty of mathematics

Xia Hao used to be a coach of the football team of Xi ‘an School for the Blind and Dumb, but since he taught senior high school students, he temporarily put aside the work of the football team and devoted himself to preparing for the college entrance examination.

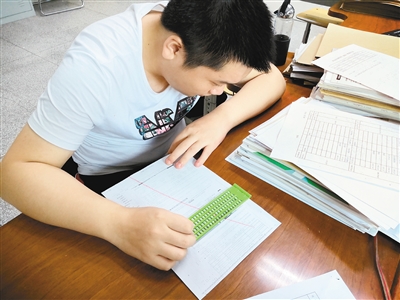

"The college entrance examination is an important threshold for children, and I hope to help them seize this opportunity to enter colleges and universities." Xia Hao said that there are only three students in his class, and he is a senior three this year, which is also the first senior three since the establishment of the school for the blind and dumb. The first session means zero starting point and zero reference, which requires Xia Hao to pay more efforts and care.

The first thing Xia Hao does when he comes to school every day is to go to the classroom first. He cleaned the classroom and checked it again for obstacles to ensure that all the students arrived at school safely.

All three students in the class like music and have formed a band, dreaming of being admitted to Changchun University for further study. Students rehearse twice a week for two hours each time. Xia Hao is the logistics and chef of the band. He always accompanies students, helps to set musical instruments and move chairs. When the band went out to perform and compete, it was Xia Hao’s job to move the stereo and musical instruments. He ran before and after by himself, and took over all the work.

Mathematics is one of the most difficult subjects for blind students. As a math teacher, Xia Hao should also guide students to "touch" the beauty of mathematics. Xia Hao said that band training usually takes a lot of time, and he is worried that he will make time for students to make up lessons every night. In order to let students understand mathematical concepts intuitively, he tried many ways of "touch teaching". "Using rice and sand can make them feel the change of volume. To understand the concept of function, I will draw graphics on the palm or back of each child."

Xia Hao said that the learning status of the three children is different. In order to let the students learn math well, he made a detailed learning record for each child, and he recorded which child was wrong and which piece of knowledge was weak. In class, if a student can’t understand it once, he will teach it three or five times, and repeat it again and again until the student understands it.

Citizen representative experience

"Teacher Xia is a class teacher and a parent. I am very touched to hear that he has to accompany students every weekend and holiday, taking them to eat hot pot and jiaozi." Feng Ruili, a community resident who lives in Changyanbao Street, said that next year, Mr. Xia will take his students to their favorite universities to take the college entrance examination, hoping that their dreams will come true. "Although the process is very bitter, Teacher Xia’s efforts will not be in vain."

— — Feng Ruili (community resident of Changyanbao Street, Yanta District)

Liang Zenghua, Teacher of Special Education College of Xi ‘an Academy of Fine Arts — —

Innovating traditional courses to stimulate students’ unique talents

Liang Zenghua is an arts and crafts teacher in the Special Education College of Xi ‘an Academy of Fine Arts. Because deaf people and ordinary people have different understandings of words and sentences, Liang Zenghua often uses pictures to replace traditional characters for teaching. Presentation (PPT) is an essential tool for Liang Ceng Hua’s class. The PPT of a class should be supported by at least two or three hundred pictures. From collecting pictures to making PPT, it takes six or seven hours to prepare lessons for each class, but Liang Ceng Hua never feels hard. He said, "Special children have a more delicate understanding of pictures and have different understandings of art. Picture teaching can better stimulate students’ creativity."

In addition to being a professional teacher, Liang Zenghua is also the vice president of the College of Special Education, in charge of teaching arrangements. In his view, every special student has a unique talent that is different from and higher than ordinary people, and the traditional arts and crafts as the teaching basis can only ensure the students’ completion of their studies and their basic survival after graduation. In order to expand the unique space belonging to special students, he looked through a lot of materials and visited many colleges and universities. After continuous research, he sorted out a set of innovative and integrated courses.

"Only by integrating two or three courses and applying arts and crafts to practical arts can students’ works better adapt to the trend of the times and the market." Liang Zenghua, for example, said that by combining the traditional fiber art class with leather goods class, students can be taught to make fiber-woven purses.

"The duty of university teachers is not only to help students master certain skills and solve employment problems, but more importantly, to help them find their future direction and gain a foothold in society." In Liang Ceng Hua’s view, special students have unique advantages, and deaf-mute students can calm down and create wonderful audio works in a silent world. "College education can make children go further on the road of art, which is also my duty."

Reporter’s sentiment

Before the interview, I always thought that specialized courses were to help special students acquire skills, but Mr. Liang Zenghua’s goal was more than that. He always stressed that every special child has absolute advantages, so that special children should walk in front of the social road and stimulate the potential of their unique space. Let students not only have works, but also have creations to keep up with the times. This is the significance of higher education. (Reporter Ma Xiang)