Source: Sina Securities

Produced by: Sina Finance Research Institute of Listed Companies

Author: New Consumer Proposition /cici

On January 31, the A-share 2023 annual report was announced, and the listed companies with excellent and poor performance in the daily chemical skin care industry were unveiled, and the industrial prosperity was unobstructed. Among the listed companies in the skin care and daily chemical industry that we are concerned about, a total of 6 companies have issued performance forecasts, and 4 listed companies have pre-increased, namely Jinbo Bio, Freda, Marubi and Shuiyang; There are two listed companies whose performance forecast "sounded the alarm" in 2023, namely Blue Moon Group and Qingsong Shares.

Among them, Qingsong Co., Ltd., as the leading OEM of beauty and skin care, has weak profitability, and its main body of cosmetics business is Northbell acquired at a high premium, thus forming a huge goodwill. After the performance commitment period, Northbell’s "performance changed dramatically" and suffered successive losses in 2021-2022, which also led to huge goodwill accrual in 2021 and 2022. It is worth noting that in 2023, Northbell’s revenue declined and its net profit continued to lose money, which is also the fundamental reason for the sluggish performance of Qingsong.

For Blue Moon Group, the market leader of household cleaning care, we think that the fundamental reason for its performance loss is still the serious product homogeneity and the channel expansion that is less than expected, and the marketing expenditure is greatly increased or secondary.

Why is it difficult to make money in the upstream of the foundry leader Qingsong?

Although the daily chemical skin care foundry is located in the upstream link of the cosmetics industry chain, it is often a section with weak profitability in the industry chain, which is closely related to the low bargaining power and high production cost of the foundry. Among all the listed companies of daily chemical skin care that released the performance forecast, only Qingsong Co., Ltd., the foundry leader, continued its performance loss.

The original core business of Qingsong Co., Ltd. mainly includes beauty OEM and turpentine processing. At the end of 2022, the company completed the divestiture of turpentine deep processing business, and the company’s main business structure also changed to cosmetics business. The company’s main income and profits were concentrated in cosmetics business.

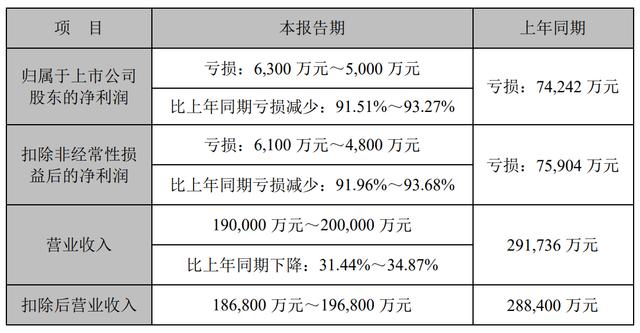

In 2023, after the divestiture of turpentine deep processing business, the company’s performance did not bring many surprises to investors. It is expected that the annual revenue will decline and the net profit will continue to lose money. Specifically, the company expects to achieve a total revenue of 1.9-2 billion yuan in 2023, which is expected to decrease by 31.44%-34.87% year-on-year; The loss of net profit attributable to shareholders of listed companies is 50-63 million, and the loss of net profit not attributable to the mother is 48-61 million. The net profit attributable to the mother and the net profit not attributable to the mother are still struggling in the whirlpool of losses.

The main body of cosmetics business of Qingsong Co., Ltd. is Northbell. Northbell is mainly engaged in cosmetics ODM business, and its main products include masks, skin care products, wet wipes, etc. Its cooperative domestic brands cover many well-known brands of skin care and daily chemical listed companies, such as Perfect Diary under Yixian E-commerce, Winona under Betaine, etc. The cooperative listed companies include shanghai jahwa, Freda, Huaxi Bio, Betaine, etc.

Although it cooperates with a number of big brands, Northbell’s own profitability is not strong. In 2019, Qingsong acquired 90% equity of Northbell at a price of 2.43 billion yuan, forming a goodwill of 1.366 billion yuan. The corresponding performance commitment is: the audited net profit attributable to the owner of the parent company after deducting non-recurring gains and losses realized by Northbell in 2018 is not less than 200 million yuan; Northbell’s total net profit in 2018 and 2019 is not less than 440 million yuan; Northbell’s total net profit in 2018, 2019 and 2020 is not less than 728 million yuan.

From 2018 to 2020, Northbell realized net profit of RMB 210 million, RMB 243 million and RMB 287 million respectively, and accumulated net profit of RMB 740 million, fulfilling its performance commitment. After the performance commitment period, Northbell’s performance immediately changed face. In 2021, the operating income was 2.509 billion yuan, down 6.05% year-on-year, and the operating profit was 66 million yuan, which turned from profit to loss year-on-year.

It is worth noting that in 2023, the company devoted almost all its energy to the cosmetics business and failed to turn losses. According to the company’s performance forecast, in 2023, Northbell’s revenue will decline and its net profit will be lost. It is estimated that its operating income will be 1.9-2 billion yuan, down year-on-year; The estimated net profit loss is 45-38 million yuan.

Blue Moon sounded a profit warning due to increased marketing expenses? In the first half of the year, sales by category and offline channels dropped sharply.

On January 17th, Blue Moon Group, which was listed on the Hong Kong stock market, issued a profit warning with pre-reduced performance. It is expected that by the end of fiscal year 2023, the comprehensive profit attributable to shareholders of the company will be reduced by not less than HK$ 230 million compared with HK$ 611.4 million attributable to shareholders of the company for the year ended December 31, 2022.

According to the company’s announcement, the decrease in expected profit is mainly due to the increase in sales and promotion expenses, including increasing publicity through different sales channels, multimedia, omni-channel and consumer education to enhance the coverage of various sales and distribution channels and new products. It is noteworthy that in the first half of 2023, the company’s sales and distribution expenditure was HK$ 1.059 billion, a year-on-year decrease of 7.7%. This may indicate that in the third and fourth quarters of 2023, Blue Moon Group increased its marketing expenses.

The core reason for Blue Moon Group to increase its marketing expenditure may still lie in the serious homogenization of products and the unexpected channel development. The slogan "Blue Moon, Creating a New Era of Laundry in China" is deeply rooted in people’s hearts, and the brand of Blue Moon has become synonymous with laundry detergent. At the beginning of 2012, the market share of Blue Moon has reached 52.7%.

However, due to technical barriers and low barriers to entry, the dividend period of the Blue Moon did not last long. Domestic and foreign daily chemical enterprises urgently laid out the laundry detergent market and raced around the land, and the market quickly became a red sea from the blue ocean.

In order to compete for market share, brands spare no effort in marketing. Inviting popular stars to speak on their behalf and reducing prices have become the necessary marketing means for going out of the circle. Under this influence, the blue moon’s unique pattern has also been threatened by domestic and foreign brands such as Libai, Carving, Verus, Jinfang and Mystery. Although "winning the first comprehensive share of similar products for N consecutive years" is the core propaganda point of Blue Moon, several head enterprises are evenly matched, and the gap is small. The market share of Blue Moon Group is far less than that in the early stage of industry development.

With the intensification of brand competition in the market, Blue Moon Group is also slightly passive. In the first half of 2023, the sales of various products of the company fell sharply, of which the income of clothing cleaning and care products was HK$ 1.958 billion, down 20.1% year-on-year. The income from personal cleaning care products was HK$ 120 million, down 47.9% year-on-year; The income from household cleaning care products was HK$ 145 million, down 28.2% year-on-year.

In addition to product marketing, online and offline channel development is equally important for daily chemical brands. Judging from the channel expansion of Blue Moon in recent years, Blue Moon was removed from KA stores such as RT Mart and Carrefour in June 2015. Although Blue Moon returned to hypermarkets in a low-key manner in 2017, this move also weakened the advantages of Blue Moon’s offline channels to some extent.

In terms of channels, in the first half of 2023, the sales of offline distributor channels and direct sales to major customers declined significantly. Among them, online channel sales accounted for the highest proportion of HK$ 1.448 billion, down 1.9% year-on-year; The second channel of sales accounted for the offline distributor channel, with sales of HK$ 642 million, down 40.5% year-on-year; The revenue from direct sales to major customers was HK$ 132 million, down 49.5% year-on-year.

In the first half of 2023, the sales by category and channel dropped sharply, and the marketing expenses dropped. The company attributed the main reason for the decline in profit to the increase in marketing expenses or it was difficult to convince investors. Specifically, the root cause of Blue Moon Group’s profit decline in 2023 is the decline in sales of a certain category of products, or the decline in sales of a certain channel, as well as the overall inventory situation of the company, which remains to be further analyzed after the company’s official financial report is issued.